Government Loan Programs

FHA Loans

An FHA loan is insured by the Federal Housing Administration, a federal agency within the U.S. Department of Housing and Urban Development (HUD). The FHA does not loan money to borrowers, rather, it provides lenders protection through mortgage insurance (MIP) in case the borrower defaults on his or her loan obligations. Available to all buyers, FHA loan programs are designed to help creditworthy low-income and moderate-income families who do not meet requirements for conventional loans.

FHA loan programs are particularly beneficial to those buyers with less available cash. The rates on FHA loans are generally market rates, while down payment requirements are lower than for conventional loans.

Some of the other benefits of FHA financing:

- Only a 3.5 percent down payment is required.

- Closing costs can be financed.

- Lower monthly mortgage insurance premiums and, under certain conditions, automatic cancellation of the premium.

- More flexible underwriting criteria than conventional loans

- FHA limits the amount lenders can charge for some closing cost fees (e.g. the origination fee can be no more than 1% of mortgage).

- Loans are assumable to qualified buyers.

VA Loans

VA guaranteed loans are made by lenders and guaranteed by the U.S. Department of Veteran Affairs (VA) to eligible veterans for the purchase of a home. The guaranty means the lender is protected against loss if you fail to repay the loan. In most cases, no down payment is required on a VA guaranteed loan and the borrower usually receives a lower interest rate than is ordinarily available with other loans.

Other benefits of a VA loan include:

- Closing costs are comparable and sometimes lower - than other financing types.

- No private mortgage insurance requirement.

- Right to prepay loan without penalties

- The Mortgage can be taken over (or assumed) by the buyer when a home is sold.

- Counselling and assistance available to veteran borrowers having financial difficulty or facing default on their loan.

Although mortgage insurance is not required, the VA charges a funding fee to issue a guarantee to a lender against borrower default on a mortgage. The fee may be paid in cash by the buyer or seller, or it may be financed in the loan amount.

A VA loan can be used to buy a home, build a home and even improve a home with energy-saving features such as solar or heating/cooling systems, water heaters, insulation, weather-stripping/caulking, storm windows/doors or other energy efficient improvements approved by the lender and VA.

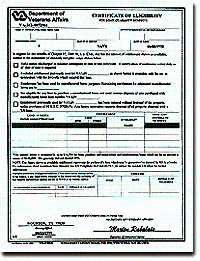

Veterans can apply for a VA loan with any mortgage lender that participates in the VA home loan program. A Certificate of Eligibility from the VA must be presented to the lender to qualify for the loan.

USDA Loans

The United States Department of Agriculture (USDA) understands the importance of vibrant rural communities and the families that make them thrive. In line with this commitment, USDA offers a specialized loan program designed to empower individuals and families with the opportunity to own homes in eligible rural and suburban areas. With low to moderate incomes in mind, USDA loans provide access to flexible financing options and competitive interest rates, making homeownership more achievable than ever.

Discover the exceptional advantages of USDA loans:

- Zero Down Payment: One of the most remarkable features of USDA loans is the ability to purchase a home without a down payment. This unique offering eliminates a significant barrier to homeownership, allowing you to transition from renting to owning with ease.

- Competitive Interest Rates: USDA loans boast highly competitive interest rates, ensuring that you secure the best financial terms for your investment.

- Flexible Eligibility: Contrary to common misconceptions, USDA loans are not solely for farms or agricultural endeavors. They encompass a wide range of eligible properties in rural and suburban locales, making homeownership achievable for many.

- Lenient Credit Requirements: While good credit is always beneficial, USDA loans cater to individuals with varying credit histories, making it an excellent option for those working on building or repairing their credit.

- Affordable Mortgage Insurance: USDA loans feature cost-effective mortgage insurance, ensuring that you can enjoy the benefits of homeownership without unnecessary financial burden.

- Supporting Sustainable Living: By choosing a USDA loan, you're supporting sustainable living and contributing to the growth and prosperity of rural communities across the nation.

For more on USDA loans click here: USDA HOME LOANS

To learn more about these Government Loan types, contact us today: 407-834-3377