Improving Your Credit Score

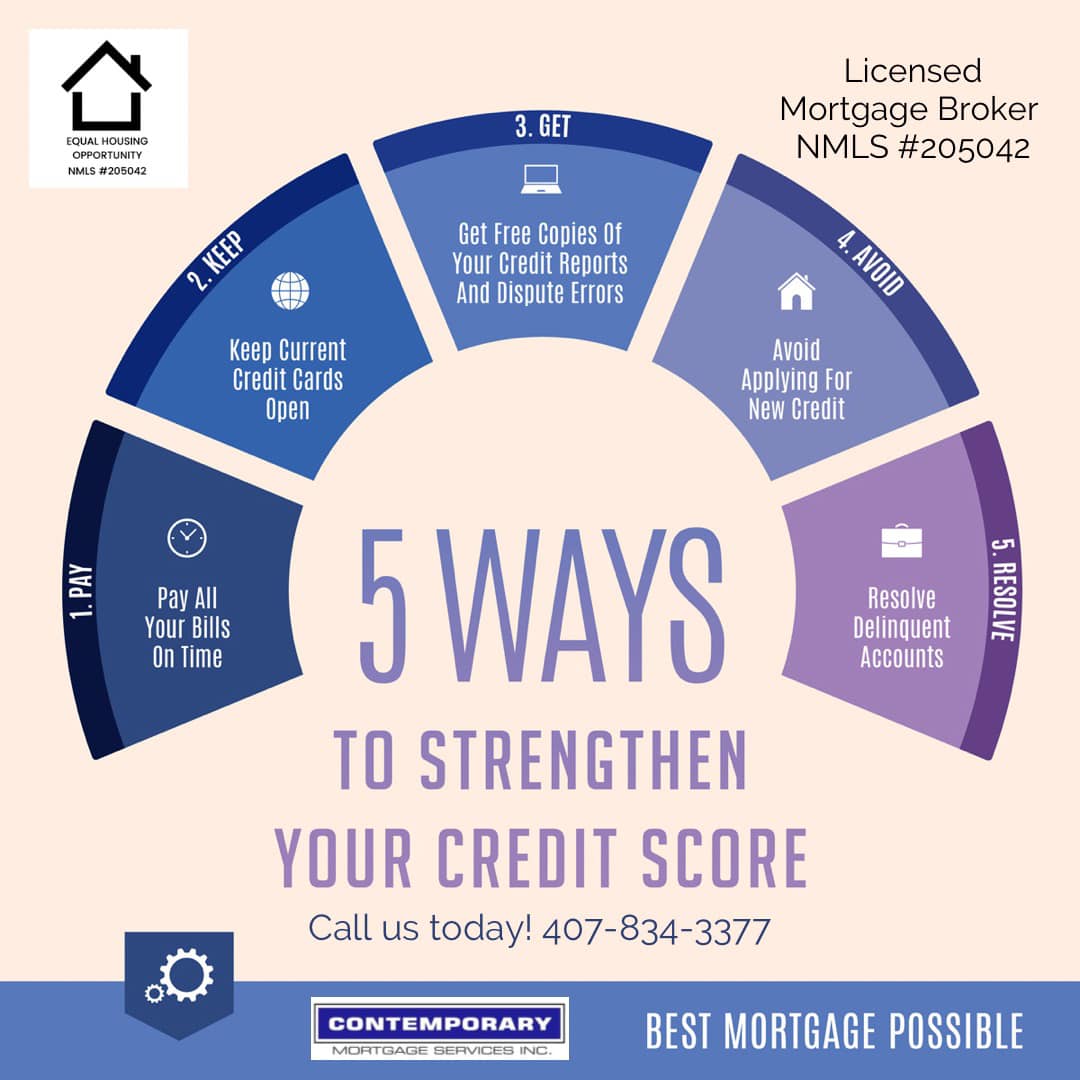

How can you improve your credit score?

It can be very difficult to change your score in the time between when most people decide to buy a home or refinance their mortgage and when they apply. But if you plan ahead, there are strategies you can live with to make sure when you apply for a loan your score is as high as possible.

- Make sure that the information each of the three credit reporting bureaus has on you is consistent and up to date. Order a copy of your credit report about once a year, and dispute any inaccuracies. Here is a link for how to order your free credit report: https://www.contemporarymortgage.com/gettingyourcreditreport

- A general rule of thumb is to try to keep your balances at or below 30% of their credit limits (i.e. If you have a credit card with a $10,000 credit limit, and currently have a $4,000 balance, paying the balance down to $3,000 should have a more positive impact on your credit score). At or below 10% is even better.

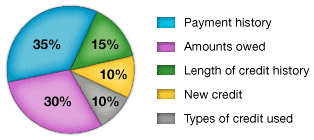

- The two main components of your credit score, are your payment history and the amounts you owe. See the below graph for the full breakdown.

- Bankruptcy filings and foreclosures, which can stay on your credit report for as long as 10 years, can significantly lower your score.

- It's never a good idea to take on more credit than you can handle.

- Late payments work against you. It's extremely important to pay bills on time, even if it's only the monthly payment.

- Don't "max out" your credit lines. Since the size of the balance on your open accounts is a factor, lower balances are better. (30% balance to credit limit ratio, helps, and 10% is even better)

- Avoid multiple credit inquiries / credit checks within a certain amount of time from each other.

- Note: Theoretically, if a series of credit reports are requested on your behalf during a limited amount of time, your score goes down until time passes without any inquiries. Changes in the law though have made "consumer-originating" credit report requests not count so much. Also, a series of requests in relation to getting a mortgage or car loan is not treated the same as a number of credit card requests in a limited time. This is because the credit bureaus, and lenders, realize that people request their own credit reports to keep up with what's on them, and smart consumers shop around for the best mortgage and car loans.

- Unsolicited credit card solicitations in the mail don't count against your credit report, so don't worry.

It's said that by carefully managing your credit, it's possible to add as much as 50 points per year to your score.

More Information on Credit Scores:

How your credit score plays a role in the home buying process:

Before they decide on the terms of your mortgage loan (which they base on their risk), lenders need to discover two things about you: your ability to repay the loan, and your willingness to pay back the loan.

- To understand your ability to repay, they assess your income and debt ratio.

- To assess your willingness to repay, they use your credit score.

- The most widely used credit scores are called FICO scores, which were developed by Fair Isaac & Company, Inc.

- The FICO score ranges from 350 (very high risk) to 850 (low risk). You can learn more on FICO here.

- Credit scores only consider the information contained in your credit profile. They do not take into account your income, savings, amount of down payment, or demographic factors, like sex, race, nationality or marital status. Fair Isaac invented FICO specifically to exclude demographic factors like these.

- Credit scoring was developed to assess a borrower's willingness to repay the loan, while specifically excluding any other demographic factors.

- Your current debt load, past late payments, length of your credit history, and a few other factors are considered.

- Your score is calculated with positive and negative information in your credit report.

- Late payments count against you, but a record of paying on time will improve it!

- Your credit report must have at least one account which has been open for six months or more, and at least one account that has been updated in the past six months for you to get a credit score.

- This payment history ensures that there is sufficient information in your report to generate an accurate score.

- Some folks don't have a long enough credit history to get a credit score. They may need to build up a credit history before they apply.

For information on how to receive your free annual credit report, click here: Getting Your Credit Report.

Contact us today for some additional tips on how to improve your credit score. 407-834-3377 or info@contemporarymortgage.com